www tax ny gov online star program

Please try again later. STAR helps lower property taxes for eligible homeowners who live in New York State school districts.

The following security code is necessary to prevent unauthorized use of this web site.

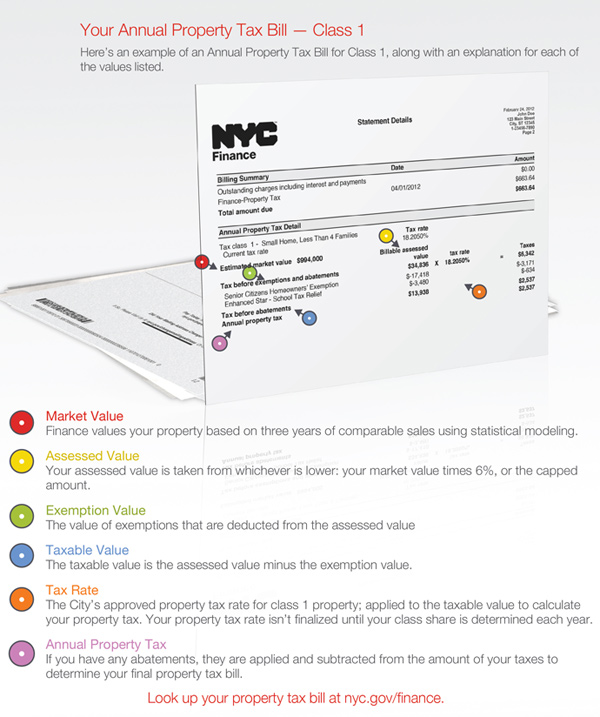

. STAR property tax relief program Whats New. If you are using a screen reading program. New York State recently altered the STAR program lowering the maximum income limit for the Basic STAR tax exemption to 250000.

Please try again later. If you are approved for E-STAR the New York State Department of Taxation and Finance will use the Social Security numbers you provide on this form to automatically verify your income eligibility in subsequent years. STAR Check Delivery Schedule.

The Village of Freeport has no role in administering this program. The Enhances STAR Exemption will provide an average school property tax reduction of at least 45 annually for seniors living in median-priced homes. The Online Services is currently unavailable.

The School Tax Relief STAR and Enhanced School Tax Relief E-STAR benefits offer property tax relief to eligible New York State homeowners. Enrollment in automatic income verification is mandatory. The credit is available for low and.

STAR is the New York State School Tax Relief program that provides an exemption on a portion of school property taxes or a rebate check for owner-occupied primary residences. The following security code is necessary to prevent unauthorized use of this web site. Homeowners not currently receiving STAR who meet the programs eligibility requirements may apply for the STAR tax credit with the New York State Department of Taxation and Finance.

Enhanced STAR is for homeowners 65 and older. This application is for owners who had a STAR exemption on the same property in the 20152016 tax year and wish to apply for Enhanced STAR. The Online Services is currently unavailable.

Only available to homeowners who have been receiving the STAR exemption on their same primary residence since 2015 and appears as as a reduction on the school tax bill. The STAR program is the New York State School Tax Relief Program that provides an exemption from school property taxes for owner-occupied primary residences. Enter the security code displayed below and then select Continue.

Go to navigation Go to content. If you dont already have an account its easy to create one. NYS budget offers property tax rebate.

Due date for all applications is June 1st. Who Can Apply Homeowners not currently receiving the STAR exemption who meet the programs eligibility requirements may apply for the STAR tax credit with the New York State Department of Taxation and. Beginning with the October 20192020 school tax bill the state will automatically switch current Basic STAR tax exemption participants with a household income greater than 250000 and less than or equal to 500000.

The benefit is estimated to be a 293 tax reduction. NEWS10 The states budget is now providing 25 million eligible New Yorkers a property tax rebate. To guarantee participation in this voluntary program employees must email a completed accurate Over-40 Enrollment Form to the Business Services Center at.

Enter the security code displayed below and then select Continue. There have been some changes in how certain homeowners will apply for STAR and in how they receive their STAR benefit. By submitting this application you grant your permission.

Your benefit may increase by as much as 2 each year. Nys department of taxation finance rp-425e 2022-23 office of real property tax services application for school tax relief enhanced star exemption if you are not currently receiving the star exemption with the town of brookhaven do not file this form you must register with nys department of taxation finance. For more information see the Over40 Comp Time II Pilot Program Description.

ENHANCE STAR is for homeowners age 65 and older with incomes of 86300 or less. There are two types of STAR benefits depending on household income. The School Tax Relief STAR program offers property tax relief to eligible New York State homeowners.

With an Online Services account you can make a payment respond to a letter from the department and moreanytime anywhere. Receive your STAR check directly from New York State. New for 2019 If you are receiving the Enhance STAR exemption but are not enrolled in the Income Verification Program you must renew your application and fill out a seperate form for IVP.

Basic STAR is for homeowners whose total household income is 500000 or less. STAR exemption to register with the Tax Department in order to receive the exemption in 2014 and beyond Program applies to more than 26 million Basic STAR recipients Senior citizens receiving Enhanced STAR exemption are not impacted by this legislation All property owner questions should be directed to DTF at 518 457-2036 2. This State-financed exemption is authorized by Section 425 of the Real Property Tax Law.

If you are eligible and enrolled in the STAR program you. The Office of Employee Relations has recently announced the Over40 Comp Time II Pilot Program for the program year 2022-2023. The STAR program continues to provide much-needed property tax relief to New York States homeowners.

Online Services is the fastest most convenient way to do business with the Tax Department. There are 2 types of STAR exemptions or rebate checks - basic and enhanced. If you are using a screen reading program.

The STAR Program provides school district property tax relief to all residential property owners and enhanced property tax relief to income eligible senior citizens age 65 or older. Were processing your request. New applicants who qualify for STAR will register with New York State instead of.

Nyc Residential Property Tax Guide For Class 1 Properties

The School Tax Relief Star Program Faq Ny State Senate

Tax Basics Military Personnel And Veterans

Receiver Of Taxes Town Of Oyster Bay

What Is The Basic Star Property Tax Credit In Nyc Hauseit

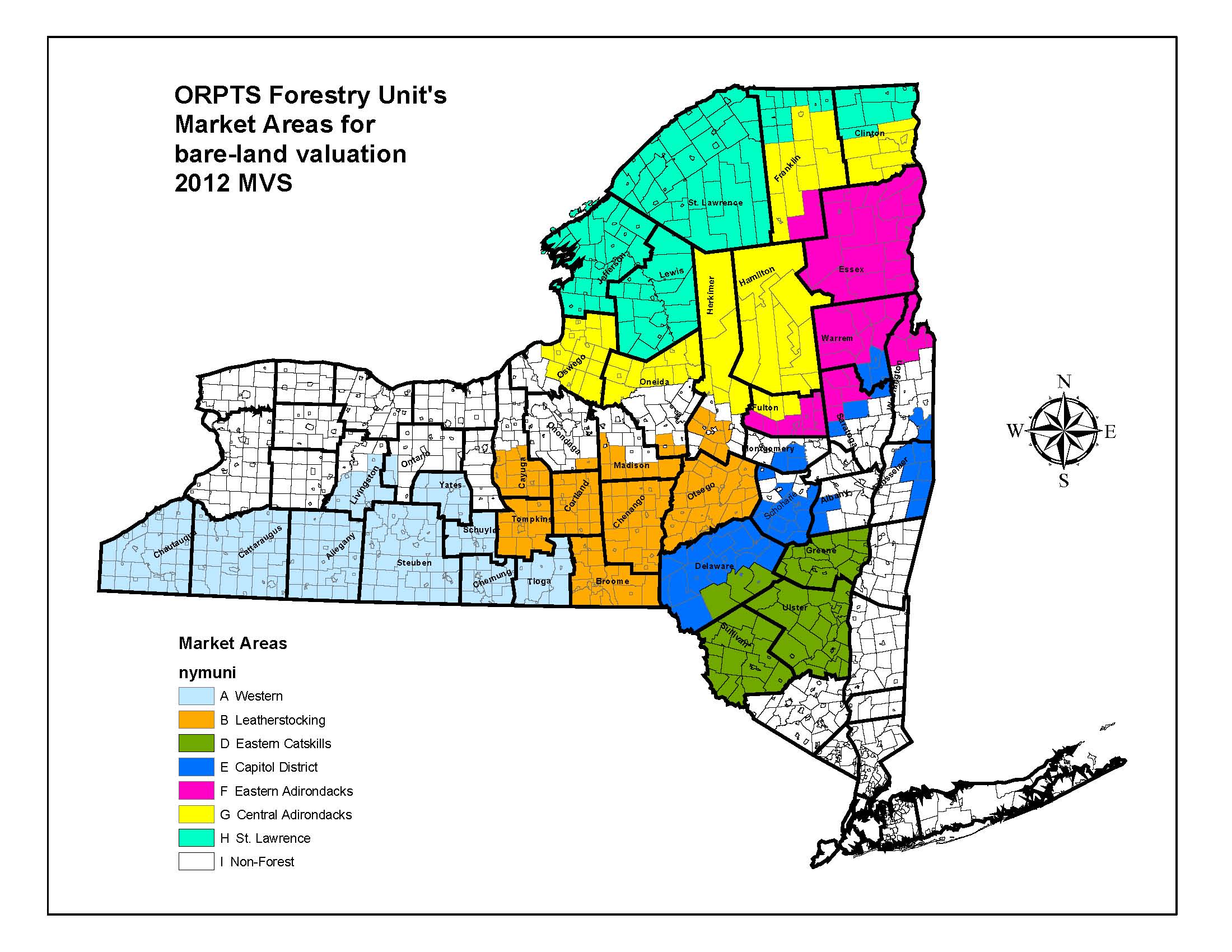

Forestry S Bare Land Valuation Map

Download Free Illustrations Of Tax Invoice Paid Stamp Accountant Accounting Amount Bill Billing B Tax Lawyer Pinterest For Business Free Illustrations

Should You Be Charging Sales Tax On Your Online Store Sales Tax Tax Money Amazon Video

Enhanced Star Income Verification Program Ivp Enhancement Stars Income